Weekly Budget Worksheet

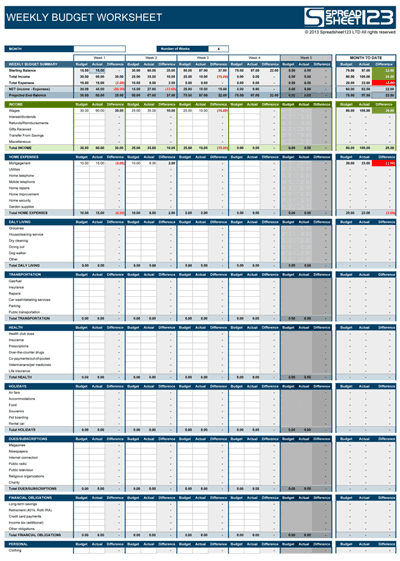

Organize your finances using these weekly and bi-weekly budget worksheets for Excel, by Alex Bejanishvili | Updated:Our Weekly Budget Template is created to help you in allocating a budget for a single week or a bi-week for various expenses at the start of the week and then calculates the difference at the end of the week or even at the end of the month. You can allocate a budget for a week or bi-week, and record the actual amount being used against each category during the week. This difference between the allocated budget and the actual budget gives the total expense incurred. One can easily allocate budget for a category of the expense and record the actual cost incurred for that category during the number of weeks in the month. This may vary between 4 or 5 weeks.

Each expenditure is populated to calculate the weekly projected end balance. The spreadsheet enables you to record all sorts of payments or expenses. We recommend you update this sheet regularly for monitoring the actual cost incurred against the budgeted cost in order to plan the weekly budget correctly. The expenses section records different kinds of expenses incurred, such as Home, Daily Living, Transportation, etc. The Bi-Weekly spreadsheet provides the summarized budget bi-weekly and also calculates the budget and expenditure incurred for all four weeks.

Weekly Budget Spreadsheet

for Excel® 2003+, OpenOffice & Google DocsFile: XLS

File: XLSX

File: OTS

File: SHEET

1.0.7

Microsoft Excel® 2003 or Higher (PC & Mac)

Not Used

Not Required

Alex Bejanishvili of Spreadsheet123.com

User License Agreement

Contact Us

How to Use Weekly Budget Spreadsheet

Begin by downloading the template and recording your income details. Also allocate a budget for every type of expense at the start. This sheet should be regularly updated to keep track of the actual expense incurred under each head. The spreadsheet Weekly Budget records the details of all the income sources and the amount received through each source for a current week. The various categories of the income are:

- Wages

- Interests / Dividends

- Refunds / Reimbursements

- Transfer from Savings

- Miscellaneous

The sheet provides a weekly budget summary table that offers details of the Starting Balance, Total Income and Total Expense, and the net income and expense specifics. You can also get a detailed projected and end balances, and the difference between the two. The net value of each sub-table is calculated separately. The weekly and bi-weekly analyses help you get a better idea of the overall budget targets and the amount that you are able to save. It also helps you make better decisions on your weekly and bi-weekly savings and expenditures. The template also provides the details of Month to Date income and expense values. The Projected End Balance of difference for the current week is carried forward as the Starting Balance of the following week.

The spreadsheet maintains the record of each penny spent during any week. Furthermore, the Weekly Budget Template has various heads and associated tables for every subcategory. These categories are:

- Home

- Daily Living

- Transportation

- Entertainment

- Health

- Holidays

- Recreation

- Dues & Subscriptions

- Personal

- Financial Obligations

- Miscellaneous Payments

The Bi-Weekly spreadsheet gives a summary of the Budgeted Amount and the Actual Amount on a bi-weekly basis. The Net Projected End Balance for all the weeks of the current week is also calculated automatically in this spreadsheet. The Net Balance is calculated by subtracting the Total Expense from the Total Income and adding the Starting Balance to it.

What does the "Projected End Balance" value mean?

The Projected End Balance is the amount of money you can save in a week from your income. The value would be achieved if the budgeted goals have been attained for the expenses that are incurred during the week.

What is the importance of a Weekly budget?

Weekly Budget Plan helps you achieve your savings targets. The expenses can be assessed on a daily basis and a decision could be taken immediately to avoid any unnecessary expenses that would hinder the process of saving or would hinder your budget in the long run. It helps you to have control over your financial future.

Excel Function used in this template

- SUM(number1, [number2], [number3], [number4], ...)

- IF(logical_test, [value_if_true], [value_if_false])